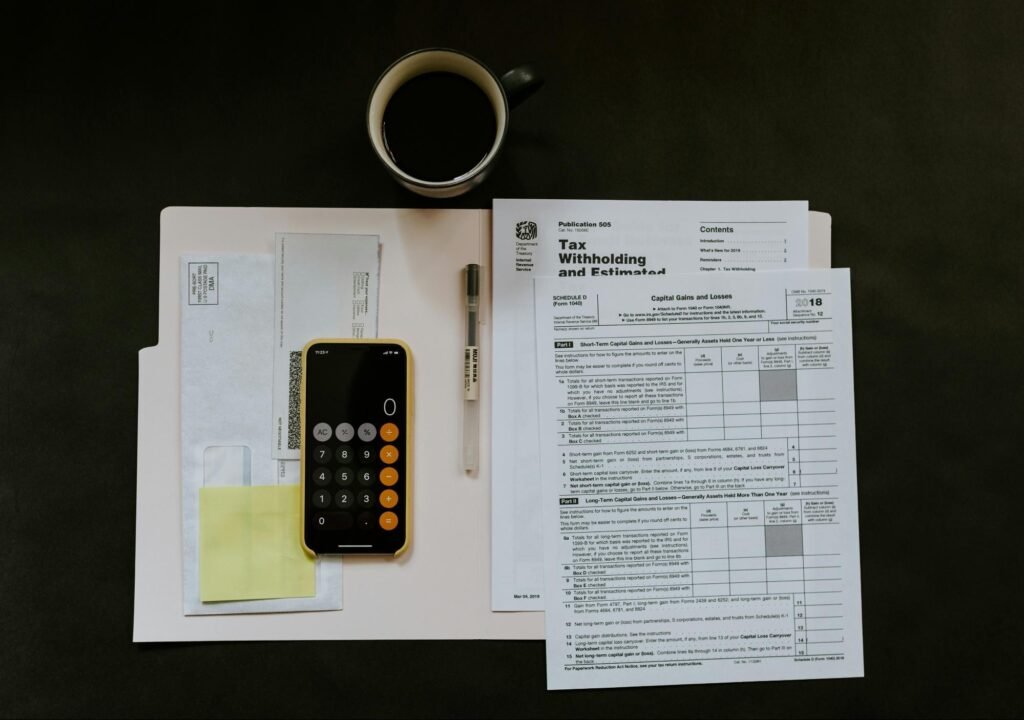

For many individuals, the words “tax debt” can invoke a feeling of fear and uncertainty. It’s easy to feel overwhelmed by the complexities of tax laws and the consequences of falling behind. But understanding the nuances of tax debt is critical to maintaining financial stability and resilience. If you’re facing challenges with tax debt or simply want to be prepared for the future, this guide will provide valuable insights. Keep reading to learn how to navigate this common financial hurdle.

Understanding Tax Debt and Its Implications on Personal Finance

Tax debt occurs when one fails to pay taxes owed to the government. It’s not an uncommon situation; however, the implications can be serious, affecting credit scores, incurring interest and penalties, and leading to a lien on personal assets. Understandably, this can contribute to significant financial stress and impact one’s quality of life.

Individuals may find themselves in debt to the Internal Revenue Service (IRS) for various reasons, including underpayment, non-payment, or errors on tax returns. The first step in tackling tax debt is recognizing the problem and assessing the total amount owed.

Once you understand the scope of the debt, it’s imperative to act quickly. The longer the tax debt goes unpaid, the more penalties and interest accrue, deepening the financial hole. At this stage, exploring options such as payment plans, offers in compromise, or seeking tax debt relief may be beneficial.

Strategies for Negotiating Payment Plans and Settlements With the IRS

One of the primary strategies for managing tax debt is to negotiate a payment plan with the IRS. Such arrangements allow taxpayers to pay off debt in a series of more manageable amounts over time. The IRS offers several types of payment plans depending on the amount owed and the taxpayer’s financial situation.

Taxpayers may also consider an offer in compromise, which allows them to settle their tax debt for less than the full amount owed if they meet certain conditions. This can be a viable option for those facing extreme financial hardship or when there is doubt as to the collectability of the debt.

It’s essential to come to the negotiating table with a clear understanding of your financial position. Documentation of your income, expenses, and asset equity will be required to propose a realistic payment plan or settlement. The IRS will use this information to determine your ability to pay and the fairness of the proposal.

How to Avoid Common Pitfalls When Resolving Tax Debt Issues

When attempting to resolve tax debt issues, common pitfalls can hinder progress and exacerbate the problem. One of the most frequent mistakes is procrastination. Delaying action not only increases debt through penalties and interest but also limits options for relief.

Borrowing money to clear tax debt might seem like a quick fix, but it can lead to a cycle of debt if not managed carefully. Considering options such as an IRS payment plan often proves more sustainable and less risky than high-interest loans or credit card advances.

Some taxpayers try to evade their debt by ignoring the IRS or hiding income and assets. This approach can lead to more severe consequences, including criminal charges. Transparency and communication with the IRS are far more effective in achieving a solution.

Long-term Financial Planning to Prevent Future Tax Debt Problems

To prevent future tax debt issues, it’s important to engage in long-term financial planning. This means setting aside money for taxes throughout the year and staying on top of tax law changes that could affect you. Automated savings and keeping abreast of current tax guidelines can safeguard against unexpected tax liabilities.

Maintaining accurate and thorough financial records is also fundamental to financial planning. Records facilitate correct tax filings and provide clear evidence in case of an audit. This due diligence minimizes the likelihood of mistakes that might contribute to tax debt.

Building an emergency fund is another prudent step in financial planning. Unexpected financial difficulties can result in tax debt, but having savings can alleviate the pressure to meet tax obligations even during tough times. Consistent saving is a protective measure against the unpredictable nature of finances.

Overall, successfully navigating the tax debt maze requires a combination of proactive measures and informed decisions. Whether you’re negotiating with the IRS, avoiding common mistakes, or planning for the future, a strategic approach to personal finance will pave the way to resilience. Never hesitate to seek professional advice, and remember that with the right steps, you can overcome tax debt obstacles and secure your financial health.